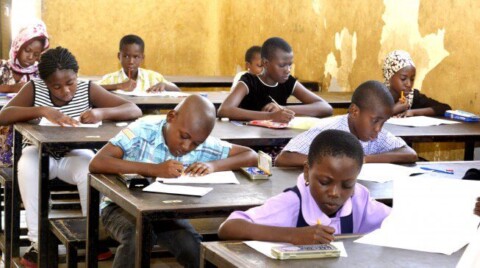

The Nigerian Education Loan Fund (NELFUND) has announced the disbursement of ₦107.7 billion to 581,878 student beneficiaries across the country, a milestone that is already contributing to lower dropout rates and broader access to tertiary education. The agency revealed that ₦61.3 billion was allocated to institutional fees while ₦46.3 billion went towards upkeep allowances.

By the close of the 2024/2025 academic session portal on September 30, 2025, a total of 846,462 applications had been received. The portal is expected to reopen in October for the 2025/2026 academic session.

Akintunde Sawyerr, Managing Director of NELFUND, explained that the loan scheme operates on a zero-interest basis, a deliberate decision to make the initiative more appealing amid economic challenges and public hesitation toward borrowing. According to him, the interest-free structure was introduced to encourage more students to remain in school and pursue higher education.

Sawyerr highlighted that prior to the establishment of NELFUND, many students who had already spent years in school were forced to withdraw due to sudden financial constraints. He noted that the loan scheme has since reduced dropout rates and motivated more young Nigerians to transition from secondary to tertiary education.

The loan features flexible repayment terms. Beneficiaries are not required to begin repayment while studying or during the National Youth Service Corps (NYSC) year. Repayment begins two years after the completion of NYSC. For beneficiaries in formal employment, employers are mandated to deduct 10 percent of their salary and remit it to NELFUND. Repayment pauses automatically if a beneficiary becomes unemployed, making it effectively a pay-as-you-earn arrangement.

While emphasizing the scheme’s student-friendly nature, Sawyerr clarified that it is not a grant but a soft loan. He advised students to choose courses that align with employability and national development priorities, stressing that repayment is an integral part of the program’s sustainability.

He added that the NELFUND scheme, with its interest-free model and supportive repayment system, stands out as one of the most accessible education finance initiatives in Nigeria. Early data, he said, already shows a significant positive impact on tertiary education access and retention rates nationwide.